For beginners, the stock market can seem overwhelming with its confusing terminology and chaotic trading. But understanding the fundamentals of stockmarket analysis will enable you to make informed investments and reach financial success. Here we’ll give you a basic guide and some tips and tricks for success in the stock market.

Part 1: What’s the Stock Market Analysis in Section 1?

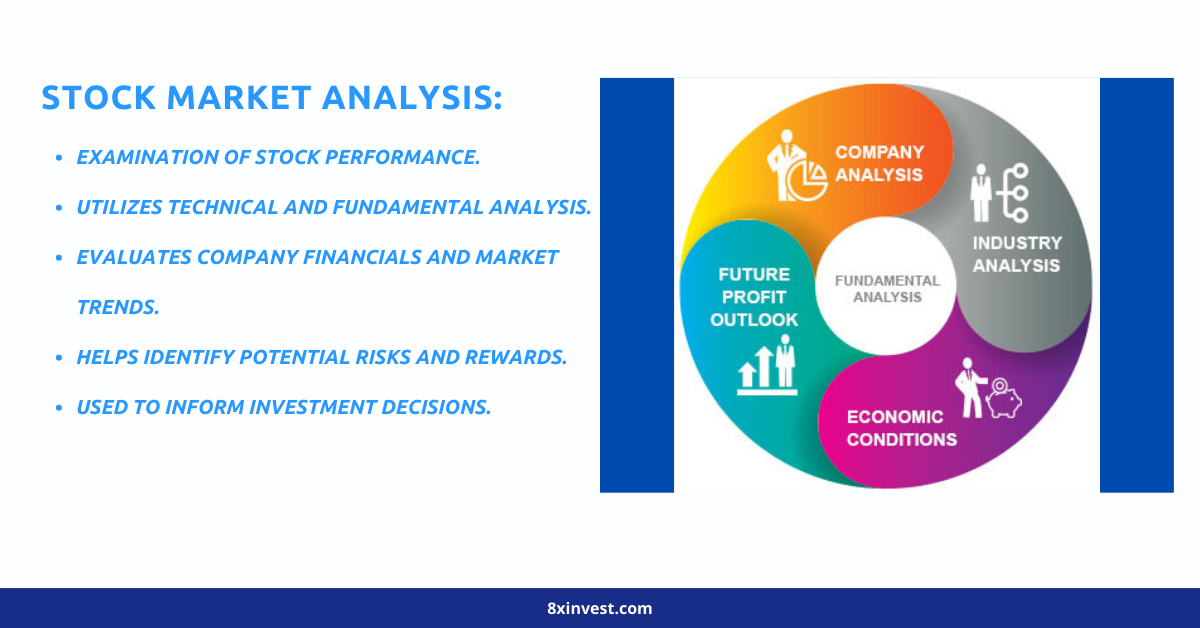

Stock market analysis involves closely analyzing and interpreting the performance of individual stocks and companies to spot patterns, trends, and investment opportunities. There are three primary methods that can be employed for this task: technical analysis, quantitative evaluation, and fundamental analysis.

Technical analysis is the practice of analyzing price charts from the past to detect patterns and tendencies that can be used for forecasting future price movements. It relies on the idea that history repeats itself, meaning patterns observed once may also appear elsewhere.

Fundamental analysis examines the economic, financial and social elements that drive a company’s success. It includes studying financial accounts and industry trends to anticipate a business’ potential growth and profitability.

Quantitative Analysis is the study and forecasting of stock value using mathematical or statistical models. It states that market behavior can be explained or predicted using formulae and mathematical equations.

Part 2: Evaluating Stock Market Relevance

Stock market research is essential for investors in order to decide whether they should buy, sell or keep a particular stock. Not only does it help you avoid costly errors but also uncover profitable investing opportunities. Here are some key advantages of conducting such research:

Identifying Trends, Patterns and Opportunities: Stock market research can be beneficial to investors by spotting patterns that could be used to predict future price changes. By analyzing historical price charts and other market data, investors may identify signs that may suggest a buying or selling opportunity. The stock market may aid investors in evaluating the growth potential and profitability of a firm. This action might result in increased profits for them.

Part 3: Methods and Suggestions for Stock Market Analysis

This is the earliest phase of stock market analysis, consisting of research and evaluation. It include analyzing financial statements, industry trends, and macroeconomic variables that might influence stock values.

Utilize Technical Analysis Tools: Utilize technical analysis tools such as moving averages, relative strength indicator (RSI) and Fibonacci retracements on historical price charts to detect patterns or trends that could be used to anticipate future price changes.

Pay Attention to News and Events. Stock prices can be affected by economic indicators and earnings reports, helping investors make informed decisions on when to purchase, sell, or hold a stock.

Diversify Your Portfolio. Diversification is an integral component of stock market analysis. Diversifying a portfolio can help investors reduce risk and boost their chances of financial success.