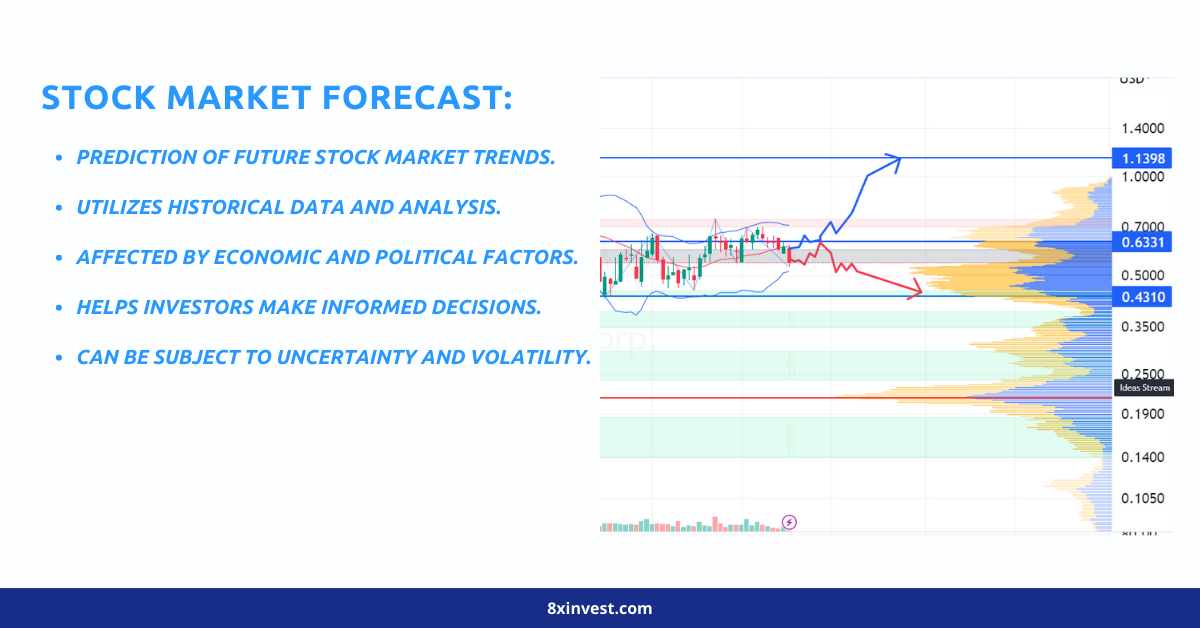

Stock market forecasting requires an in-depth examination of multiple elements. This article will elaborate on each method mentioned previously, as well as provide insight into how investors can utilize these insights to make informed investment decisions.

Technical Analysis

Technical analysis is the practice of examining past market data to uncover trends and potential trading opportunities. Technical analysts use moving averages, support/resistance levels, relative strength indexes to analyze market data, forecast future performance, and make predictions. Technical analysis helps investors recognize market patterns so they can make informed decisions about whether or not to buy, sell, hold, or trade stocks; it may even uncover breakout patterns or trend reversals. Unfortunately, technical analysis can be affected by market noise or volatility which could make projecting accuracy difficult.

Fundamental Analysis

Fundamental research can be useful to identify low-cost companies with promising growth prospects. However, it’s essential to recognize the limitations of fundamental analysis; it does not take into account market emotion or external factors like geopolitical developments and economic statistics which could influence short-term performance.

Emotional Analysis

Sentiment analysis aims to forecast market sentiment and provide guidance in future performance evaluations. Monitoring social media and news to gauge public sentiment towards stocks, and the entire market. Investors now have access to real-time market sentiment data through sentiment research. Sentiment analysis allows people to make educated decisions on whether to buy, sell or keep stock based on sentiment shifts. Sentiment research can also be used for finding trading opportunities based on sentiment changes. On the downside, false news or manipulation of social media could distort market perceptions. Furthermore, sentiment analysis fails to consider fundamental factors like a company’s financial health or economic indicators that could impact performance in the stock market.

Stock market forecasting can be a complex and dynamic process that requires an objective evaluation of many factors. Investors can make informed decisions about when to buy, sell or hold stock by using technical analysis as well as fundamental analysis, sentiment analysis and machine learning algorithms; each approach having its own advantages and drawbacks that need to be carefully considered when selecting which approach best meets their investment goals and risk tolerance. Keeping abreast of market developments while using reliable forecasting techniques increases their chances for successful investments in stocks.